I have submitted my Notice of Appeal (NOA), what happens next?

Following the submission of an NOA, you will receive confirmation concerning the registration of your appeal. The appeal will then enter the process towards hearing. When the appeal has been listed for Callover you will receive directions from the Tribunal Offices to submit a Precis of evidence. The Callover takes place under the Direction of the Chairperson in order to list appeals for hearing dates. You may begin preparing your Précis of evidence at any time from the Notification of Appeal.

Am I submitting Revaluation or Revision?

Revaluation is a national programme undertaken by the Valuation Office. Revaluation is a process by which all rateable properties in a local authority area are valued periodically, and at the same time, by reference to a single valuation date . For further information please click here.

Revision is a process arising from a Material Change of Circumstances (MCC) to a commercial or industrial property, such as: an extension, a subdivision or an amalgamation of two or more properties or, a completion of a new commercial property.

For information on Revision appeals and what counties this applies to, please click here

Can I pay by cheque or bank draft?

No

Following the implementation of the National Payments Plan by all Civil Service bodies, from 1st of January 2022 the Valuation Tribunal no longer accepts cheques and bank drafts as payment of appeal fees. Payments must be made electronically, through the online appeal form or over the phone by means of a debit or credit card, or by the Electronic Funds Transfer.

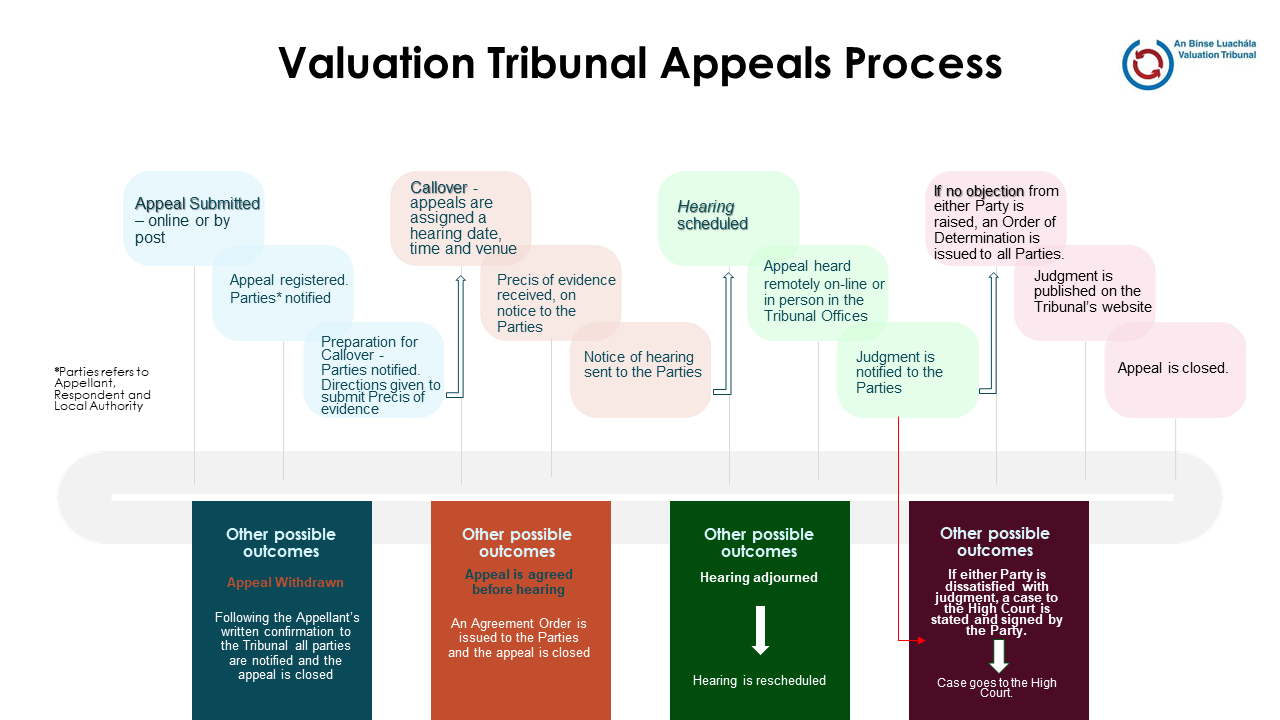

What are the steps of this process?

Appeals Process – Graphic – PDF/Download Click Here

I’ve given you all the documents already, what else is needed?

When submitting an appeal, the only document that is required is a completed and signed Notice of Appeal (NOA) form. Any additional documentation provided at the time will be kept on the appeal file. However, when appeal has reached the Callover stage and when Directions by the Tribunal Office are given, Precis of evidence must be furnished by the Appellant in a signed document format.

The NOA form submitted at the beginning of the process, is just the initial step as to why you are appealing. Further documents under ‘Precis’ must then clarify and support in evidence the reasons for the appeal. You may begin preparing your Précis of evidence at any time.

How long does the process take?

The Tribunal has experienced unprecedented levels of appeals in recent years as a result of the National Revaluation Programme carried out by the Valuation Office. As of the 1st of January 2024, the Tribunal has 1,879 appeals on hand. While the bulk of these appeals relate to the National Revaluation Programme, a number also relate to vacant site appeals and derelict site appeals, which are not commercial rates appeals but are determined as part of the statutory functions of the Valuation Tribunal.

What is a Precis of evidence? What documents am I supposed to submit?

In order to make an informed decision on your appeal, the Tribunal requires a Precis of evidence from both parties. A Precis of evidence is a collection of supporting evidence to your appeal, as listed here under rule 36. of the Valuation Tribunal (Appeals) Rules 2019. These may include maps, photographs and comparative properties as evidence. In essence, it is the ‘story’ or reasoning of your appeal.

When is the decision effective from?

The decision is effective from the date on which the Valuation Tribunal issues a Determination Order. For example, ‘Dated this Friday the 8th of July, 2022,’ means that the effective date is 08/07/22.

Is the Determination Order the last step in the process?

The Determination Order issued to the parties is the last step in the appeal process. If the Tribunal determines for the valuation to be changed, the Valuation Office will amend the property valuation and will notify the Local Authority of the change. The Local Authority will then recalculate your commercial rates accordingly.

Can you change my rates?

The Valuation Tribunal has no dealings with or impact on rates paid to the Local Authorities. The Valuation Tribunal determines appeals against valuations by the Valuation Office of commercial properties for rating purposes. If the Tribunal determines for the valuation to be changed, the Valuation Office will amend the property valuation and will notify the Local Authority of the change. The Local Authority will then recalculate your commercial rates accordingly.

What is the section 36 email I keep getting?

The Valuation Tribunal appeals process is governed by the Valuation Act 2001-2015, as amended. Section 36 of the Valuation Act requires that parties are notified of relevant correspondence issued on their appeal. This does not always necessitate action on your end, depending on the contents of the correspondence.

For example, any correspondence provided to us by the Valuation Office or Local Authority concerning your appeal, will be then forwarded to you ‘under’ Section 36.

It is a guarantee of transparency.